Setting up webSAM to connect to Xero

TABLE OF CONTENTS

Connecting to Xero

Log into SAM and go to Setup

Navigate to Interfaces, Settings

Select Xero and Configure

In the Organisation section select Connect to Xero

This will open a new browser window and prompt you to log into your Xero account.

Select Log In

Note: this step will be skipped if you are already logged into Xero

Select Allow access to continue

Select Allow access to continue

You will then be redirected to a SAM confirmation screen. Select Close Window

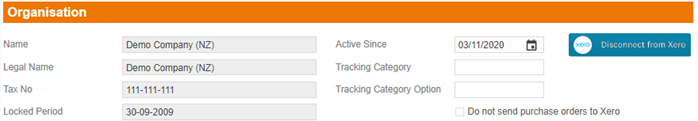

The Organisation section will now display information about the Xero account SAM has been connected to.

Data to Sync

The Customer and Supplier sections provide options to sync SAM customer or supplier data to the Xero contacts, or vice versa.

If you have been using SAM and the Xero account is new then you can Export to Xero to create all of the SAM customers/suppliers into the Xero account,

If the SAM system is new then you can Import from Xero to create all of the Xero conacts in SAM

Or if both systems have been active and have existing data then there is a Match option to link duplicate records.

Select the View button and then the Refresh button to download and display the latest Xero customers and suppliers.

The syncing of customers should be done first, then suppliers

Account Mapping

The Accounts section is where the SAM general ledger accounts are mapped to your Xero chart of accounts.

Select the View button and then the Refresh button to download and display the latest Xero chart of accounts for your organisation. Next use the dropdown menu to select and map the Xero code to the SAM one

If an account is missing in Xero there is a quick option of using the Create button to create the required account in Xero and map it to SAM

More detailed instructions for this section

Tax Rates

Finally, the tax rate should be checked. These are loaded by default depending on your country selection in the SAM System Configuration

? Need more help?

Our support team are here to help, click here to get in touch with us.